CIBA

Certified Investment Banking Associate

The Certified Investment Banking Associate (CIBA) is a professional certification tailored to fit the schedules of busy professionals. With our 100% online learning platform and multimedia study materials; this program provides participants with our easy-to-access and revolutionary training platform. This platform includes audio interviews with industry experts, instructional videos covering the best practices, fundamentals and insights. We are training tomorrow’s business leaders today.

Participants take a hands-on approach to studying the investment banking business, learning about mergers and acquisitions (M&A) process, and evaluating firms based on various financial models. Participants will become familiar with how M&A works, different valuation methods and preparing debt and equity offerings.

CIBA Enrollment

Select your payment option to begin your certification course today.Notice: Function WP_Scripts::localize was called incorrectly. The $l10n parameter must be an array. To pass arbitrary data to scripts, use the wp_add_inline_script() function instead. Please see Debugging in WordPress for more information. (This message was added in version 5.7.0.) in /www/financetraining_709/public/wp-includes/functions.php on line 6078

Investment Banking Associate Certification Learning Objectives

- Put your studies in perspective through exposure to the business of investment banking.

- Recognize that “valuation” lies at the core of an investment banker’s skill set.

- Prepare to learn about valuation by gaining exposure to financial statements and accounting. Discover how figures flow between income statement, balance sheet and cash flow statement, and gain exposure to more complex topics such as depreciation, goodwill and deferred taxes.

- Learn valuation based on comparable companies’ analysis. You’ll learn how to choose comparables, find relevant financial data, analyze statistics and calculate valuation.

- Learn valuation based on precedent transactions analysis. You’ll learn how to choose transactions, find relevant historical data, analyze multiples and calculate valuation.

- Learn valuation based on discounted cash flow analysis. You’ll learn how to forecast cash flows, determine a cost of capital, compute the terminal value, discount back to the present and calculate valuation.

- Take a hands-on approach to studying financial modeling techniques including more advanced topics such as sensitivities, complex capital structures, scenario toggles and cash flow revolvers.

- Find out how the LBO process works and how LBO models can be used for valuation.

- Become familiar with the M&A process including an examination of the accretion / dilution concept.

- Become familiar with equity and debt offerings.

Benefits of the becoming a Certified Investment Banking Associate (CIBA)

- Add the CIBA Designation to your resume, assuring employers that you are dedicated to working in the industry, focused on learning more about investment banking, and able to work more efficiently after being promoted or hired.

- Advance your investment banking career by raising your level of investment banking knowledge and increasing your ability to work quickly and effectively. Specialized knowledge is valuable and an asset in our knowledge economy and mastering investment banking models, terms, and industry best practices allows you to work more efficiently than your competitors.

- Exclusive Access to tools and multimedia training resources found online within the CIBA Certification Program.

- Speak the investment banking language – Earning the CIBA Designation assures that you can attend conferences, job interviews, and other networking events while being able to contribute to conversations and understand discussions about current events or trends within the industry. Our program will help you to understand the terms and implement the tactics and tools of leading investment banking professionals.

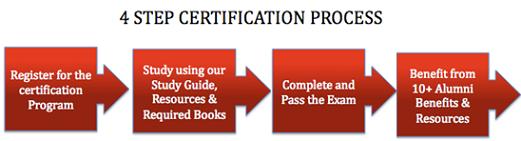

There are no weekly homework assignments, phone calls, or classes scheduled. In fact, the only set dates in our programs are the four exam dates that we offer each year. The program is entirely self-paced.

Once you have registered, you will be provided with login details to access our proprietary certification platform. After you’ve logged in, you will be able to watch the program’s video training modules, complete your strategic project (as laid out in the study guide), email our faculty with questions, complete the self-grading practice test, and schedule your online examination. Our examination is offered 100% online, which has allowed participants from over 40 countries to participate and complete our programs.

While you are enrolled in the program you can note that you are currently a candidate. For example, if taking the Financial Analysis Specialist Certification (FASC) program, you can note on your resume or business profiles that you are a FASC Candidate.

After completing the program you are then able note that you are certified in this area on your resume, professional biography, LinkedIn.com account, Facebook account, cover letters for job applications, etc. Contact us if you would like specialized sized images of the designation logo to place on your personal or social media website pages.

We live in a knowledge-based economy. Our programs are geared toward very specific fields and skill sets to help you gain specialized knowledge within areas most critical to your success. Completing a certification program allows you to show others on your resume and bio that you are more well-trained and credible than other professionals in the industry. A recent study by Gartner also showed that certification programs increased compensation by 5-11% on average, and can boost your income by as much as 30-40% annually. When an employer or potential client is choosing between you and someone with very similar work experience and education, being certified is one more thing that will make you stand out from the crowd.

Sample Video & Audio

Advanced Financial Modeling Techniques For Investment Bankers

Interview John Loudon and Byron Holley of Silverstone Capital Partners

Participants May Include:

- Analysts or associates looking to improve their investment banking industry knowledge

- Students with some professional experience who are looking for continuing education opportunities

- Seasoned professionals looking for professional self-improvement training on investment banking

- Professionals who have just taken a position as part of an investment banking team

- Banking professionals looking to improve their investment banking knowledge and leverage the changes the event industry has experienced in the past 10 years

- Investment banking placement agents and consultants

InvestmentCertifications.com is operated by the Global Training & Certification (G.T.C.) Institute, LLC. We have trained and certified well over 3,000 participants and our platform provides the #1 most practical, challenging and globally relevant certification platform.

InvestmentCertifications.com is operated by the Global Training & Certification (G.T.C.) Institute, LLC. We have trained and certified well over 3,000 participants and our platform provides the #1 most practical, challenging and globally relevant certification platform.

The self-paced financial analyst training program is delivered through online lecture videos, an audio program, a workbook, and step-by-step screen capture tutorials. Our program requires one year of previous professional experience that is relevant. Over 70% of professionals who have completed this program in the past have also completed our hedge fund, private equity, investment banking, or financial analysis programs as well.

Guaranteed Value: We are so confident that you will greatly benefit from our career coaching, practical training modules, and resume improvement from completing our programs that we offer a 100% money back refund policy. If you change your mind about completing our programs for any reason at all within the first 14 days after registering just email us and you will get your full money back in 7-10 business day. Give us a test drive and you will see why over 3,000 participants like you have completed our training programs. There are no hidden fees, and everything but the required readings are covered by this single tuition payment, which is less expensive than a single University course. GTC Institute LLC offers a 14 days refund policy from the date payment was submitted to GTC Institute LLC. Refunds can be redeemed by either calling 305-5053-9050 or sending an email along with a reason for cancellation. Any requests made after the 14-day period will be denied.

Guaranteed Value: We are so confident that you will greatly benefit from our career coaching, practical training modules, and resume improvement from completing our programs that we offer a 100% money back refund policy. If you change your mind about completing our programs for any reason at all within the first 14 days after registering just email us and you will get your full money back in 7-10 business day. Give us a test drive and you will see why over 3,000 participants like you have completed our training programs. There are no hidden fees, and everything but the required readings are covered by this single tuition payment, which is less expensive than a single University course. GTC Institute LLC offers a 14 days refund policy from the date payment was submitted to GTC Institute LLC. Refunds can be redeemed by either calling 305-5053-9050 or sending an email along with a reason for cancellation. Any requests made after the 14-day period will be denied.

Give us a test drive by registering today and you will see why over 3,000 participants like you have completed our training programs. There are no hidden fees, and everything but the required readings are covered by this single tuition payment, which is less expensive than a single University course.

This tuition investment covers:

- Lifetime access to program resources

- Instructional video modules

- Expert audio interviews

- Career coaching help

- Resume template feedback service

- Practice examination in Excel

- The online examination and grading

- Certificate of completion

Save over $2,500 by enrolling in our

Masters Certification Program